PU Prime App

Exclusive deals on mobile

PU Prime App

Exclusive deals on mobile

Hold The Global Markets In Your Hands

Our trading mobile app is compatible with most smart devices. Download the App now and start trading with PU Prime on any device, anytime and anywhere.

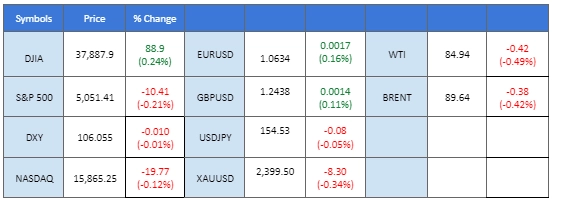

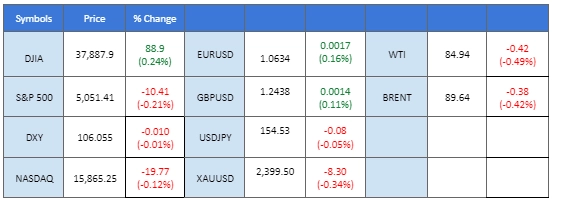

The market was roiled by unconfirmed reports of explosions in Iran, Iraq, and Syria, adding to the already tense atmosphere following Iran’s recent attack on Israel over the weekend. Anticipation of potential retaliation from Israel contributed to heightened nervousness in the markets throughout the week. Gold prices surged above the $2400 mark, while oil prices saw a gain of over 4% in the Asia opening session on Friday. The risk-averse sentiment extended to equity markets, with Asia equity markets experiencing sharp declines alongside U.S. index futures. Expectations of higher volatility persist in the U.S. equity market as it enters earnings season, with companies such as Tesla, IBM, and Qualcomm scheduled to report next week. In the currency markets, both the dollar and the Japanese yen experienced notable surges, buoyed by their safe-haven characteristics amidst the prevailing risk-averse sentiment. This flight to safety typically strengthens these currencies as investors seek stability in uncertain times.

Current rate hike bets on 1st May Fed interest rate decision:

Source: CME Fedwatch Tool

0 bps (97%) VS -25 bps (3%)

(MT4 System Time)

N/A

Source: MQL5

The Dollar Index surged following the release of robust US economic indicators, fueling expectations of a delayed Fed rate cut. Better-than-expected Initial Jobless Claims and Philadelphia Fed Manufacturing Index figures bolstered investor confidence in the greenback, while reaffirming the Fed’s commitment to maintaining higher interest rates to address inflation concerns.

The Dollar Index is trading higher following the prior rebound from the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 61, suggesting the index might extend its gains toward resistance level since the RSI stays above the midline.

Resistance level: 106.35, 107.05

Support level: 105.80, 105.25

Gold prices remained flat as upbeat US economic data and a lack of progress updates from the Middle East diminished the appeal of safe-haven assets. The surge in US Treasury yields following the positive economic indicators reduced demand for non-yield assets like gold. Amid ongoing geopolitical tensions, investors remained vigilant for developments that could influence gold’s trajectory.

Gold prices are trading flat while currently near the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 40, suggesting the commodity might trade higher since the RSI rebounded sharply from oversold territory.

Resistance level: 2375.00, 2400.00

Support level: 2360.00, 2340.00

The GBP/USD pair continues to face strong downside pressure, despite upbeat UK CPI data released on Wednesday. The dollar has rebounded from its recent technical retracement, driven by the uncertain political climate, particularly the potential for escalated conflict between Israel and Iran. This has prompted investors to flock towards the perceived safety of the dollar, overshadowing positive economic signals from the UK.

The GBP/USD pair has broken below its consolidation range, suggesting a bearish bias signal for the pair. The RSI eases toward the oversold zone while the MACD is about to cross before breaking above the zero line suggests the bearish momentum prevails.

Resistance level: 1.2440, 1.2540

Support level: 1.2370, 1.226

The EUR/USD pair erased all its gains from the previous session as the dollar regained strength following a technical retracement. Comments from Fed’s Bostic, acknowledging stickier-than-expected inflation in the US, reinforced the dollar’s resurgence. Meanwhile, the latest Eurozone CPI reading, coming in at 2.4%, suggests that the ECB may be nearing its first rate cut, reflecting concerns over the region’s economic performance.

EUR/USD has declined to its crucial support level; a drop below such a level suggests a bearish signal for the pair. The MACD failed to break above the zero line, while the RSI declined from near the 50 level, suggesting that the bearish momentum is overwhelming.

Resistance level: 1.0700, 1.0775

Support level: 1.0560, 1.0500

The Japanese yen strengthened during Friday’s Asia opening session, propelled by reports of an unconfirmed explosion in the Middle East, raising concerns of potential retaliation from Israel following Iran’s recent attack. Additionally, Japanese yen traders remained vigilant for any comments from the Bank of Japan (BoJ), anticipating possible intervention by Japanese authorities amid the yen’s sharp depreciation in recent times.

USD/JPY declined sharply and broke below its near-support level, suggesting a bearish signal for the pair. The RSI has dropped to below 50 level while the MACD is moving toward the zero line from above, suggesting a bearish momentum is forming.

Resistance level: 154.90, 156.50

Support level: 153.30, 151.85

Wall Street witnessed its fifth consecutive day of losses, marking its longest losing streak since October. Rising US Treasury yields, coupled with a hawkish stance from Federal Reserve officials, dampened investor sentiment and weighed heavily on equities. Disappointing performances from semiconductor giants further exacerbated concerns, particularly regarding the future of chipmakers amidst a strong Artificial Intelligence trend.

Dow Jones is trading lower while currently testing the support level. However, MACD has illustrated diminishing bearish momentum, while RSI is at 33, suggesting the index might enter oversold territory.

Resistance level: 39150.00, 39855.00

Support level: 37700.00, 36560.00

Crude oil prices struggled to find direction amidst conflicting market sentiment. While rising US Treasury yields supported the US Dollar, limiting gains for dollar-denominated oil, potential US sanctions on Venezuela provided some support. However, uncertainties loomed regarding the implementation of these sanctions and their impact on oil markets, prompting investors to adopt a cautious approach.

Oil prices are trading higher following the prior rebound from the support level. MACD has illustrated diminishing bearish momentum, while RSI is at 52, suggesting the commodity might extend its gains since the RSI stays above the midline.

Resistance level: 84.65, 87.50

Support level: 82.85, 80.45

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.