PU Prime App

Exclusive deals on mobile

PU Prime App

Exclusive deals on mobile

Hold The Global Markets In Your Hands

Our trading mobile app is compatible with most smart devices. Download the App now and start trading with PU Prime on any device, anytime and anywhere.

Choosing the right CFD broker is crucial for successful trading. With so many options available, it can be overwhelming to make a decision. How do you navigate the world of CFD trading platforms and find the one that suits your needs?

In this article, we will guide you through essential tips on how to choose the best CFD broker. Whether you’re interested in online forex trading, opening a forex account, or exploring options like gold trading and online commodity trading, we’ve got you covered. Let’s dive in and discover the key factors to consider when selecting a CFD broker that sets you up for trading success.

* Consider the safety and regulation of the CFD broker before opening an account.

* Check the range of trading products offered by the broker to diversify your portfolio.

* Evaluate the quality and reliability of the trading platform provided by the broker.

* Compare the trading fees and costs to maximize your potential profits.

* Choose an account type that aligns with your trading goals and preferences.

Content:

A CFD broker is a financial institution that allows traders to speculate on the price movements of various assets through contracts for difference (CFDs). CFDs are derivative instruments that enable traders to profit from both rising and falling markets without owning the underlying asset. Traders can engage in CFD trading in a wide range of assets, including stocks, currency pairs (forex), commodities, and indices.

CFD brokers provide traders with a trading platform that facilitates access to the markets and execution of trades. These platforms are specifically designed for CFD trading, offering features such as real-time market data, charting tools, and order execution capabilities.

One of the key features of CFD trading is leverage. Leverage allows traders to amplify their market exposure by trading with borrowed funds. This means that traders only need to deposit a fraction of the total position value, known as margin, to open a CFD position.

Online commodity trading is one of the popular areas within CFD trading. Traders can speculate on the prices of various commodities such as gold, oil, natural gas, and agricultural products. By engaging in online commodity trading, traders can potentially profit from fluctuations in commodity prices without physically owning or storing the commodities.

Understand What Is CFD Trading And How It Works

Find out more here

When it comes to choosing the best CFD broker, there are several crucial factors to consider. These factors play a significant role in determining the quality of your trading experience and can greatly impact your success in the financial markets. In this section, we will explore some of the key factors that should be taken into account when selecting a CFD broker.

One of the first factors to consider is the safety and regulation of the CFD broker. It’s important to choose a broker that is safe and regulated by reputable financial authorities, such as the Financial Conduct Authority (FCA), the Securities and Exchange Commission (SEC) and Financial Services Authority of Seychelle (FSA). Regulation ensures that the broker operates under strict guidelines and provides a level of transparency and security for your trading activities.

The range of trading products offered by the CFD broker is another important consideration. A good broker should provide access to a diverse range of trading products, including forex, stocks, commodities, indices, and more. This variety allows you to diversify your portfolio and take advantage of different market opportunities.

The trading platform is a crucial component of your trading experience. It is the software that you use to execute trades, analyze the markets, and manage your positions. A reputable CFD broker should offer user-friendly and reliable trading platforms, such as MetaTrader 4 (MT4) or MetaTrader 5 (MT5), which are popular choices among traders. These platforms provide advanced charting tools, indicators, and various trading features to enhance your trading strategies.

Similarly, PU Prime enables traders to monitor markets, execute trades, and manage their portfolios through our own mobile trading apps. Our mobile trading app offers features comparable to web-based platforms, including real-time market data, order placement, and account management, providing traders with the flexibility to stay connected and trade from anywhere at any time.

Practise Trading With A Free Demo Account

Create demo account

Consideration of trading fees and costs is essential when choosing a CFD broker. These fees can include spreads, commissions, overnight financing charges, and withdrawal fees. It’s important to select a broker with competitive and transparent fees, ensuring that you can maximize your potential profits without incurring excessive costs. At PU Prime, traders benefit from competitive trading costs, which are among the tightest in the industry. Low trading cost enables traders to enter and exit positions more efficiently, contributing to improved trading outcomes.

Check Out PU Prime’s Competitive Spreads And Trading Costs

Find out more

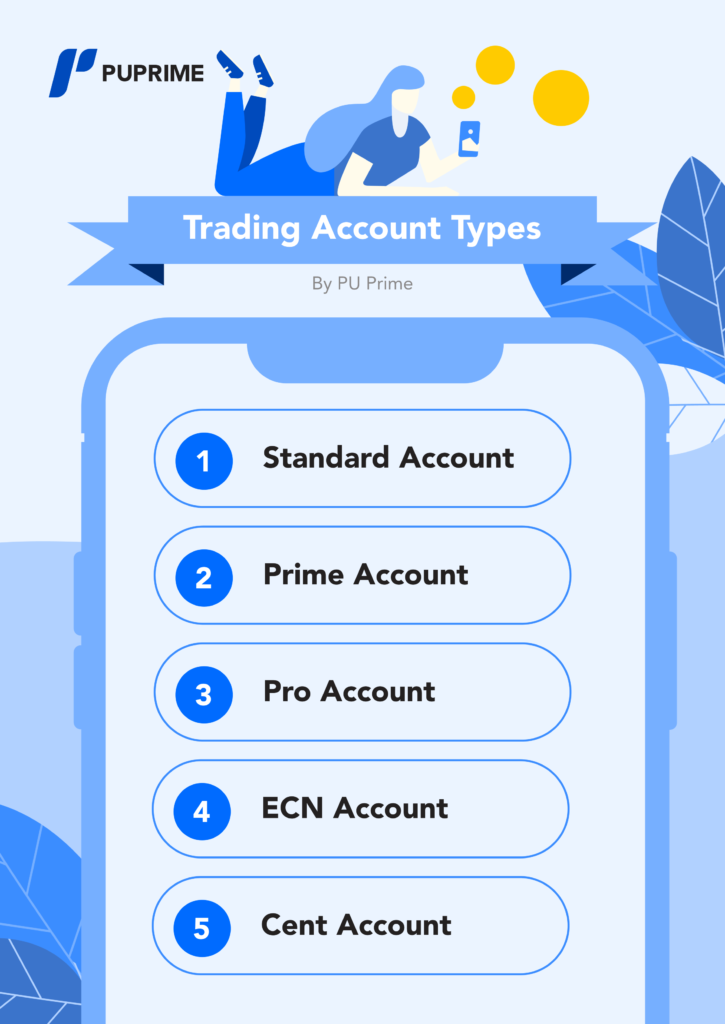

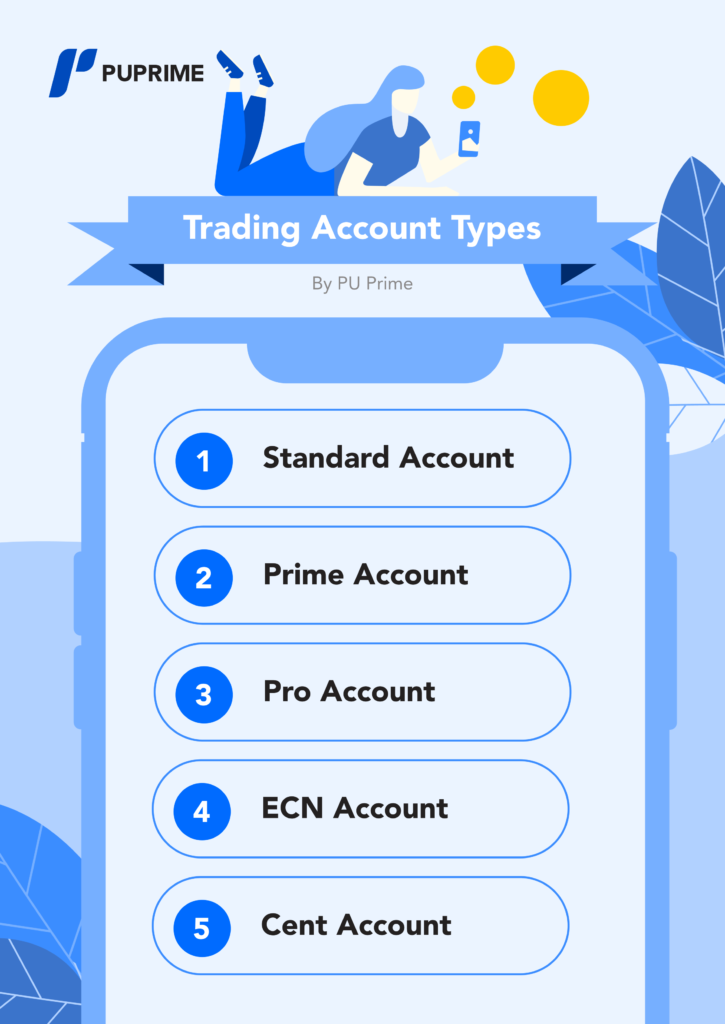

Different CFD brokers may offer various types of trading accounts to suit the needs of different traders. Common types include demo accounts, which allow you to practice trading with virtual funds, and live accounts, which involve real money. At PU Prime, we offer different types of accounts that best suits your trading needs, such as Standard accounts, Prime accounts, Pro accounts, ECN accounts and Cent accounts, where each offering its own benefits and features. Consider your trading goals and preferences when choosing the account type that best suits you.

Check Out The Different Account Types At PU Prime

Find out more

Good customer support and educational resources are invaluable when choosing a CFD broker. Look for brokers that offer responsive customer support channels, such as live chat, email, and phone support. These will be crucial in case of any issues or inquiries. At PU Prime, customer support is a top priority. Traders can rely on our dedicated support team, available 24/7, to assist with any queries, technical issues, or account-related concerns.

Additionally, educational resources, including tutorials, webinars, and trading guides, can help enhance your trading knowledge and skills, making them valuable resources for both beginner and experienced traders. PU Prime offers a wealth of educational articles and market insights curated by industry experts. These resources cover market trends, economic news, trading strategies, and risk management techniques. Also, PU Prime provides an extensive array of educational webinars and seminars aimed at empowering traders with invaluable insights and strategies.

Gain More Trading Knowledge With PU Prime’s Resources

Start reading

After considering various factors, it is clear that choosing the best CFD broker is a crucial aspect of your trading journey. Whether you are a beginner or an experienced trader, making an informed decision can significantly impact your trading success.

Remember, researching and comparing different brokers is essential before making a final decision. Take advantage of demo accounts or trial periods offered by brokers to test their services and determine which platform best suits your needs. Every trader’s requirements are unique, so it’s important to choose a CFD broker that aligns with your individual trading goals and preferences.

Open A Live Account And Start Trading

Create live account

The potential profits from CFD trading vary based on several factors, including market conditions, your trading strategy, risk management techniques, and the assets you choose to trade. CFDs allow you to profit from both rising and falling markets, but it’s important to understand that trading involves risks, and you may also incur losses. It’s advisable to start with a demo account or trade with a small amount of capital until you gain experience and confidence in your trading approach.

CFD brokers are regulated entities that must adhere to specific standards and guidelines set by regulatory authorities. It’s crucial to choose a reputable and regulated CFD broker to ensure the safety of your funds and the fairness of the trading environment. Regulatory bodies oversee CFD brokers to protect traders’ interests and promote transparency in the financial markets. Conduct thorough research, read reviews, and verify a broker’s regulatory status before opening an account.

CFD trading involves various risks that traders should be aware of, including:

Market Risk: CFD prices can be highly volatile, leading to rapid gains or losses.

Leverage Risk: CFDs allow you to trade with leverage, which amplifies both profits and losses.

Counterparty Risk: CFDs are contracts between you and the broker, so there’s a risk if the broker defaults.

Lack of Ownership: Unlike owning the underlying asset, CFDs are derivative products, and you don’t own the underlying asset.

Margin Call Risk: If your account falls below the required margin level, you may face a margin call and need to deposit additional funds.

It’s essential to have a risk management plan in place, including setting stop-loss orders, using proper position sizing, and avoiding over-leveraging.

The volatility of CFDs can vary depending on the underlying asset and market conditions. Generally, stocks of companies with high volatility, commodities like oil or gold, and cryptocurrencies tend to exhibit significant price swings, making them potentially volatile CFDs to trade. However, volatility can change over time, so it’s essential to analyze current market conditions and consider your risk tolerance before trading volatile CFDs.

CFD trading can be suitable for beginners who are willing to learn and understand the risks involved. It offers opportunities to profit from various financial markets without owning the underlying assets. However, due to the leveraged nature of CFDs and the potential for rapid gains or losses, beginners should start with a demo account or trade with a small amount of capital. It’s crucial to educate yourself, develop a trading plan, and practice risk management to enhance your chances of success in CFD trading.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.