PU Prime App

Exclusive deals on mobile

PU Prime App

Exclusive deals on mobile

Hold The Global Markets In Your Hands

Our trading mobile app is compatible with most smart devices. Download the App now and start trading with PU Prime on any device, anytime and anywhere.

* MT4 is a widely utilized electronic trading platform in the realm of online retail foreign exchange (forex) speculation.

* MT4 offers a user-friendly interface and powerful features for traders of all levels.

* The platform is compatible with various devices, including Windows, Mac, iOS, and Android.

* Traders can access real-time market data, trade multiple financial instruments, and use technical analysis tools on MT4.

* MT4 is a versatile platform that allows trading in forex as well as other financial markets.

MT4, or MetaTrader 4, is a widely utilized electronic trading platform in the realm of online retail foreign exchange (forex) speculation. Introduced by MetaQuotes Software in 2005, it enables traders to analyze financial markets, execute sophisticated trading actions, devise and evaluate trading strategies using expert advisors, and replicate the trades of other traders. Renowned for its intuitive interface, comprehensive charting features, and support for automated trading via custom scripts, indicators, and expert advisors, MT4 is a favored choice among forex traders and is supported by numerous brokers globally.

MetaTrader 4 is considered a safe trading platform. It incorporates various security measures to protect user data and ensure secure transactions. Please refer to the image below for some of our safety features.

Additionally, reputable brokers that offer MetaTrader 4 are often regulated by relevant financial authorities, providing an additional layer of security. Traders should ensure they choose a regulated broker and follow best security practices, such as keeping login credentials confidential and using strong passwords.

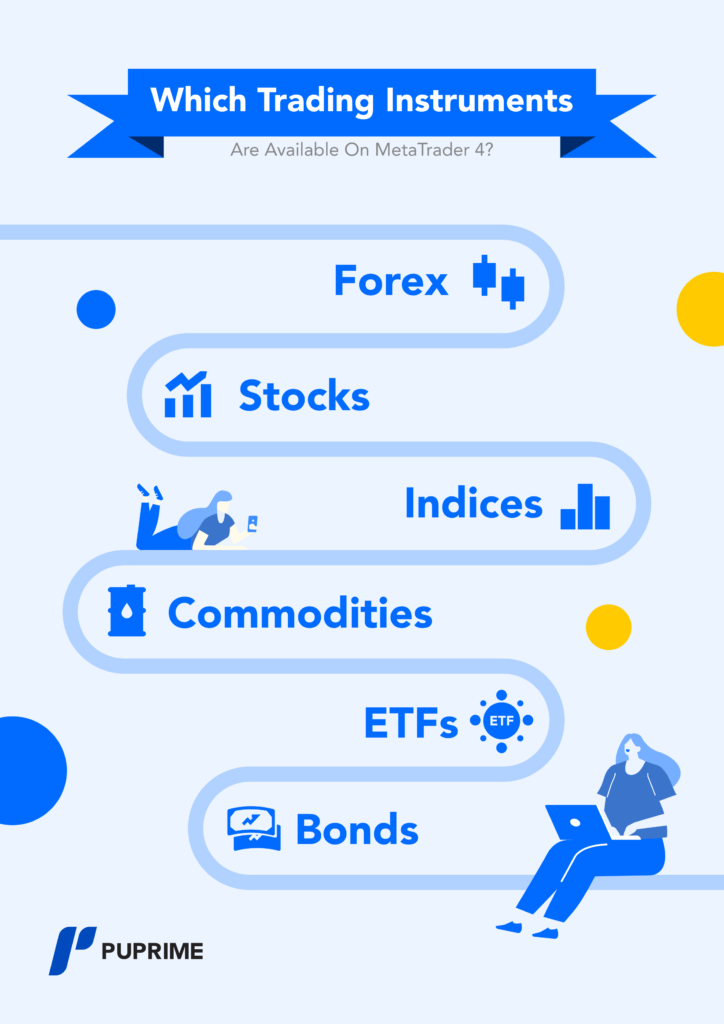

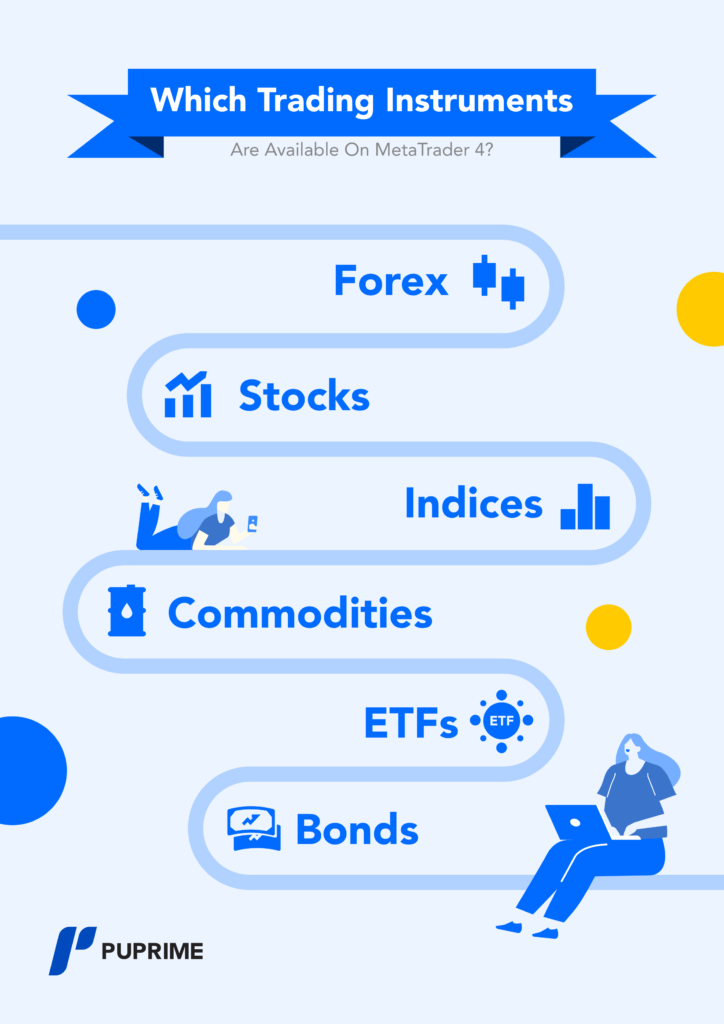

MetaTrader 4 (MT4) is widely recognized as a leading platform for forex trading. However, it offers much more than just forex trading. With MT4, traders can access and trade a variety of financial instruments across different financial markets.

MetaTrader 4 allows traders to explore the following financial instruments:

The availability of these instruments may vary depending on the broker you choose. However, many brokers offer an extensive range of financial instruments on the MT4 platform, providing traders with the flexibility to diversify their portfolios and explore various trading opportunities.

By using the same MT4 platform, traders can analyze market data, use technical analysis tools, and execute trades across multiple markets. Whether you’re interested in trading forex, stocks, or cryptocurrencies, MT4 offers a versatile platform to meet your trading needs.

As a conclusion, MetaTrader 4 is not limited to just forex trading. Traders can access and trade stocks, indices, commodities, and cryptocurrencies using the same MT4 platform.

Yes, the MetaTrader 4 platform is free to download and use. Traders can access the MT4 platform without any upfront costs. However, it is essential to note that while the platform itself is free, traders may incur fees related to trading activities such as spreads, commissions, and swap charges. These fees vary depending on the broker and the financial instruments being traded. Before engaging in live trading, it is recommended to review and understand the fee structure provided by the broker.

MetaTrader 4 offers traders a cost-effective solution for their trading needs. Traders can freely download and install the platform without incurring any expenses. This allows easy access to the robust features and functionalities of MT4, making it an attractive choice for both beginner and experienced traders.

However, it is important to note that while the MT4 platform itself is free, traders should be aware of the potential costs associated with trading activities. These costs may include spreads, commissions, and swap charges, which vary depending on the broker and the financial instruments being traded. Traders should carefully review and understand the fee structure provided by their chosen broker before engaging in live trading.

By understanding the potential costs and fee structures, traders can make informed decisions and effectively manage their trading expenses. Despite possible trading costs, MT4 remains a popular choice due to its user-friendly interface, powerful features, and flexibility across different devices.

To create a MetaTrader 4 demo account, follow these steps:

Select a reputable broker that offers MT4 as one of its trading platforms. Consider factors such as regulatory compliance, customer support, and trading conditions when choosing a broker.

Visit your chosen broker’s website and download the MT4 platform suitable for your device. MT4 is available for Windows, Mac, iOS, and Android.

Open the MT4 platform and click on “File” > “Open an Account.” Fill in the required information and select the account type as “Demo” to create a virtual trading account.

Once your account is created, go to the “File” > “Login to Trade Account” section and enter your login credentials provided by your broker.

After logging in, you will have access to the MT4 platform’s features. Use the market watch window to view available instruments, analyze charts, place trades, and monitor your positions. It is important to note that demo accounts operate using virtual funds, allowing you to practice trading without risking real money. Creating an MT4 demo account is the first step to learning the platform without risking real money. Once set up, you’ll see the user-friendly interface, where you can explore sections like Market Watch, Chart Window, Navigator, and Terminal.

Not sure how you could navigate the MT4 trading platform? Feel free to check out our beginners’ guide on how to use the MT4 trading platform.

Depositing and withdrawing money from your MetaTrader 4 (MT4) trading account is a straightforward process that depends on your broker’s payment options and procedures. A variety of funding methods are usually available, including:

* Bank transfers

* Credit/debit card payments

* E-wallets

To deposit funds into your MT4 account:

1.Log in to your MT4 account

2.Navigate to the funding section

3.Choose the desired funding method

4.Follow the instructions provided by your broker

Withdrawing funds from your MT4 account follows a similar process:

1.Submit a withdrawal request through your broker’s platform

2.Provide the necessary details

3.Follow any additional verification steps required by your broker

It’s important to note that withdrawal processing times can vary depending on your broker and the chosen withdrawal method. Be sure to consult your broker’s guidelines or contact their customer support for specific instructions regarding deposits and withdrawals.

Now that we’ve covered the deposit and withdrawal process, let’s explore whether MT4 is a free platform or if there are any associated costs.

With the popularity of the MetaTrader 4 (MT4) platform soaring among traders worldwide, selecting the best MT4 broker is crucial for optimizing your trading experience. Here are the essential tips to help you navigate the process and find the perfect fit for your trading needs.

Regulatory Compliance: Begin your search by ensuring that the broker is regulated by a reputable financial authority. Regulation provides a layer of protection for traders and ensures that the broker operates with transparency and fairness. Look for brokers regulated by well-known authorities such as the Financial Conduct Authority (FCA), the Financial Services Authority of Seychelles (FSA), or the Australian Securities and Investments Commission (ASIC).

Platform Stability and Features: The reliability and functionality of the MT4 trading platform are paramount. Choose a broker that offers a stable and user-friendly MT4 platform with advanced features such as customizable charts, technical indicators, and automated trading capabilities. A robust platform will enhance your trading efficiency and effectiveness.

Trading Costs: Consider the trading costs associated with the broker, including spreads, commissions, and overnight financing rates. While low trading costs can be attractive, be mindful of hidden fees or charges that may impact your overall profitability. Strike a balance between competitive pricing and quality of service.

Asset Selection: Evaluate the range of trading instruments offered by the broker, including forex pairs, commodities, indices, stocks, and cryptocurrencies. A diverse selection of assets allows you to explore various markets and diversify your trading portfolio according to your preferences and trading strategy.

Execution Speed and Quality: Fast and reliable order execution is crucial for capitalizing on market opportunities. Look for brokers with a reputation for fast execution speeds and minimal slippage, especially if you engage in scalping or high-frequency trading strategies. Optimal order execution can significantly impact your trading results over time.

Customer Support: Test the broker’s customer support responsiveness and effectiveness before making a decision. Prompt and knowledgeable customer support can provide invaluable assistance when you encounter technical issues or have inquiries about trading. Choose a broker that offers multiple channels of communication and operates a responsive support team.

Deposit and Withdrawal Methods: Evaluate the deposit and withdrawal options offered by the broker to ensure they are convenient, secure, and cost-effective. Look for brokers that support a variety of payment methods, including bank transfers, credit/debit cards, and e-wallets. Additionally, consider the processing times for deposits and withdrawals to avoid unnecessary delays.

Educational Resources: Consider whether the broker provides educational resources and tools to help traders improve their skills and knowledge. Look for brokers that offer trading tutorials, webinars, market analysis, and research reports to support your learning journey. Access to educational resources can empower you to make informed trading decisions and enhance your overall trading performance.

Reputation and Reviews: Research the broker’s reputation by reading reviews and testimonials from other traders. Pay attention to feedback regarding the broker’s reliability, customer service, and overall trading experience. Look for patterns or recurring issues mentioned by multiple reviewers to gauge the broker’s credibility and trustworthiness.

Yes, MetaTrader 4 is available for PC. Traders can easily download the MT4 platform directly from their broker’s website and install it on their Windows-based computer. The MT4 desktop version offers a comprehensive trading experience, providing access to all the features and functionalities of the platform.

The PC version of MT4 is highly customizable, allowing traders to tailor the platform according to their preferences. It provides advanced charting capabilities, enabling in-depth technical analysis of the financial markets. Traders can utilize various charting tools and indicators to make informed trading decisions.

Additionally, MT4 for PC supports automated trading, allowing traders to develop and deploy their own expert advisors or utilize pre-built ones. This feature enables the execution of trading strategies even when the trader is not actively monitoring the market.

With MetaTrader 4 for PC, traders can enjoy seamless integration with their broker’s platform, enabling swift and secure trade execution. It is a powerful tool for both beginner and experienced traders, providing a user-friendly interface combined with robust trading functionalities.

MT4 indicators are essential tools for traders who rely on technical analysis to make informed trading decisions. These indicators are mathematical calculations based on historical price data, helping traders analyze market trends and identify potential trading opportunities. By applying these indicators to their charts, traders can gain insights into market conditions, detect patterns, and develop effective trading strategies.

Here are some of the most popular MT4 indicators that traders commonly use:

Traders can customize these indicators by adjusting their parameters to suit their specific trading strategies and preferences. Each indicator provides different insights into market dynamics and can help traders identify entry and exit points for trades. By combining multiple indicators, traders can create a comprehensive technical analysis toolkit to enhance their trading decisions and improve overall profitability.

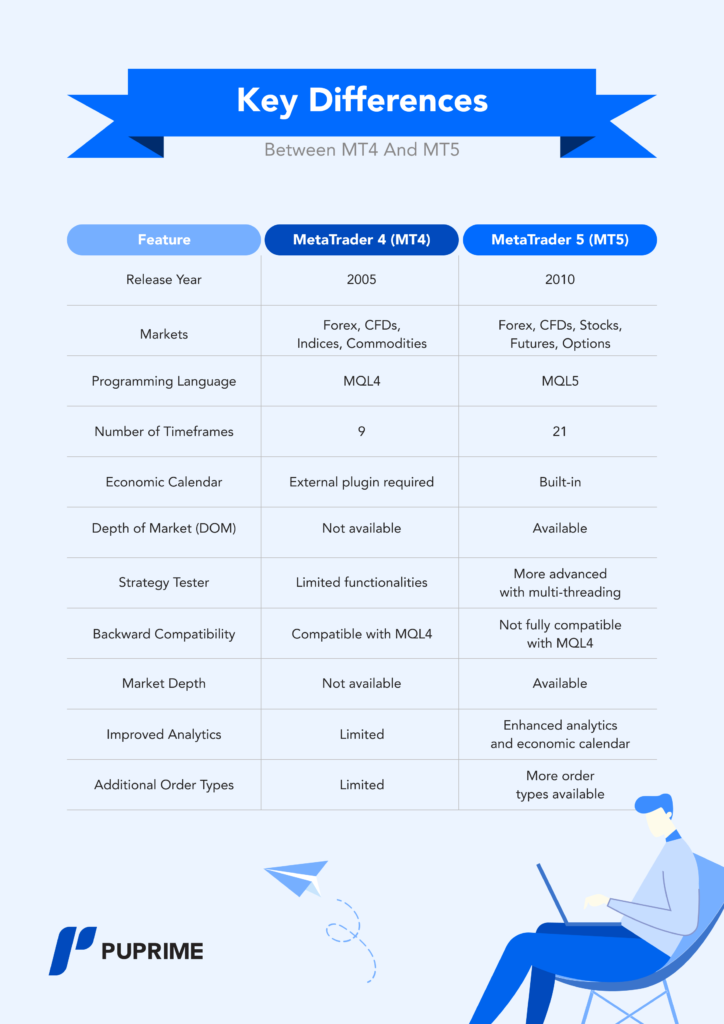

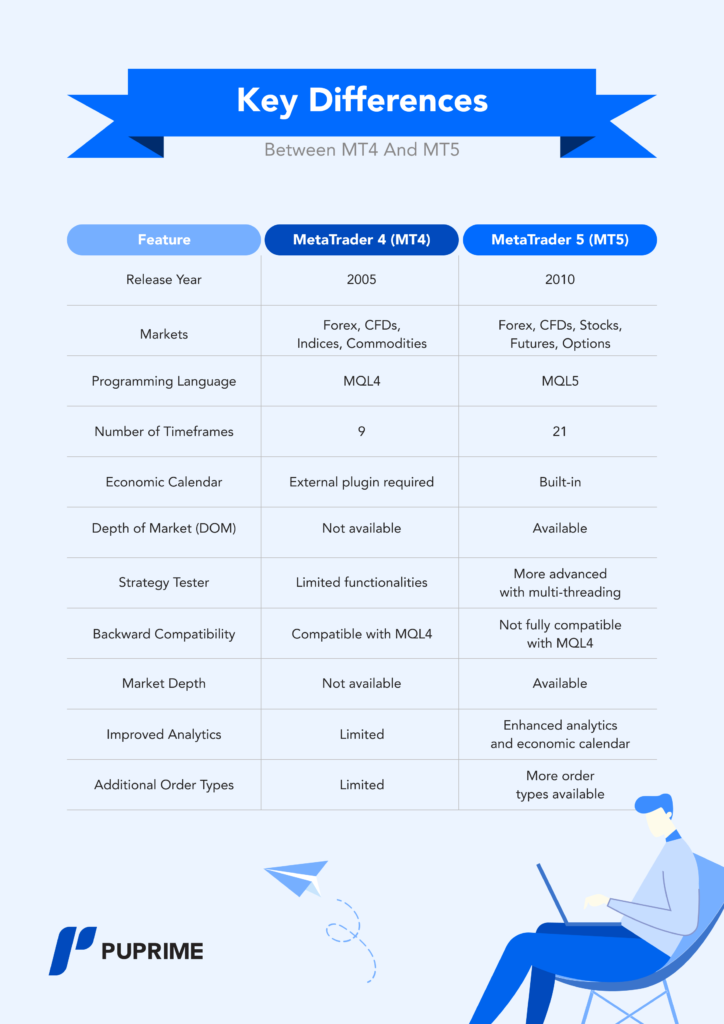

MT4 and MT5 are both trading platforms developed by MetaQuotes Software Corp. Although they share similarities, there are key differences between the two platforms.

It is important to note that while MT5 offers advanced features, MT4 remains a widely popular platform with a large user base due to its simplicity and extensive library of indicators and expert advisors.

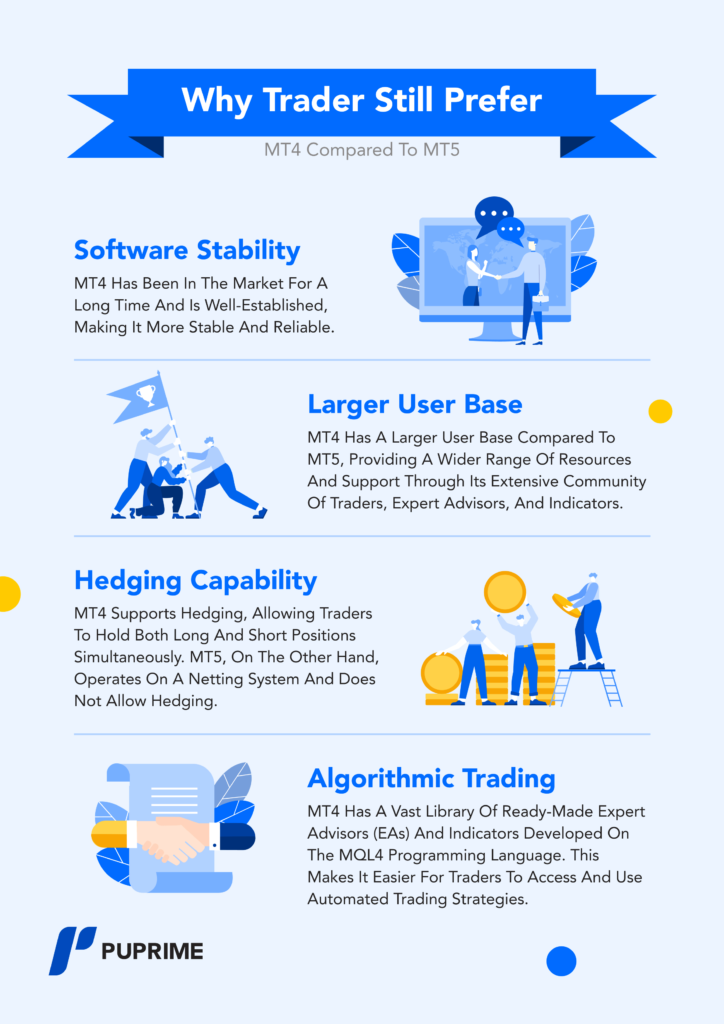

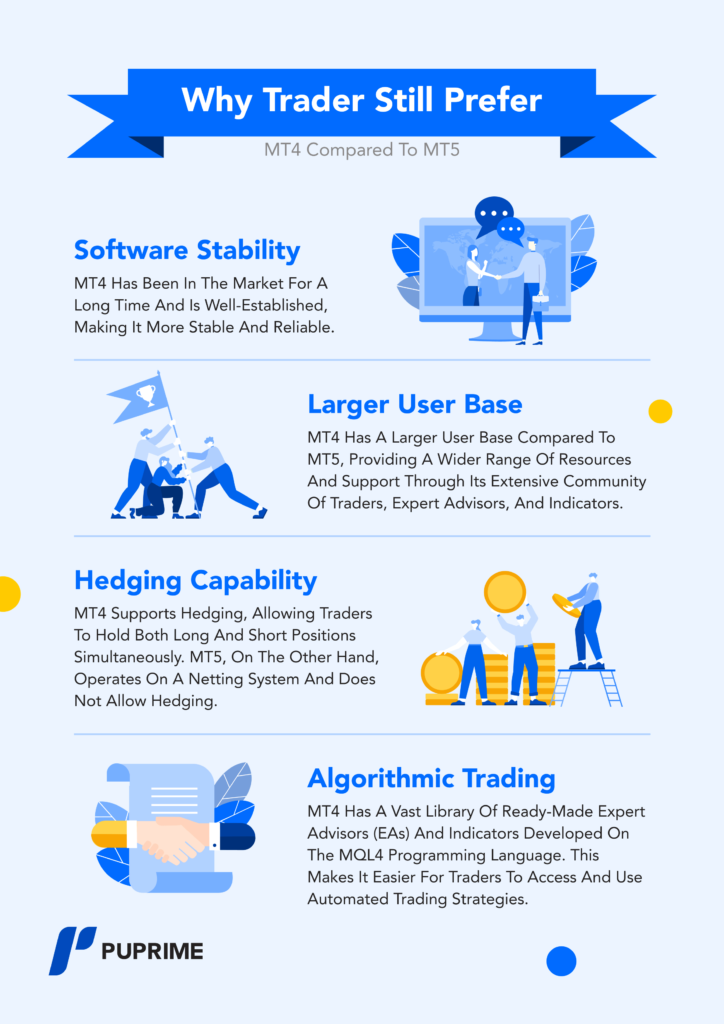

The choice between MetaTrader 4 (MT4) and MetaTrader 5 (MT5) ultimately depends on individual trading preferences and requirements. While MT5 offers advanced features, many traders still prefer MT4 for several reasons.

It is essential for traders to evaluate their specific requirements and test both platforms before deciding which one better suits their trading style and goals.

Understand some benefits of using the MT4 trading platform for forex traders.

Yes, MetaTrader supports automated trading systems through its expert advisor (EA) functionality. Traders using MetaTrader can develop or download pre-built EAs that follow specific trading strategies and execute trades automatically. These EAs can be programmed using the MQL4 or MQL5 programming language, depending on the platform version. Automated trading systems offer various advantages, including removing emotions from trading, executing trades with high precision and speed, and allowing for 24/7 trading without constant monitoring.

Traders can backtest their automated strategies on historical data to assess performance and make necessary adjustments before deploying them in live trading.

Discover some of the unparalleled advantages of MT4 and MT5 trading platforms below.

Yes, MetaTrader supports backtesting of trading strategies through its built-in strategy tester. Traders using MetaTrader, specifically MT4, can leverage historical market data to simulate trades and evaluate the performance of their trading strategies.

The strategy tester within MetaTrader allows traders to adjust various parameters such as timeframes, indicators, and order types to analyze the strategy’s profitability in different market conditions. By backtesting their strategies, traders can identify strengths and weaknesses, optimize parameters, and gain confidence in their trading approach.However, it is important to note that backtesting results are based on historical data and should be used as a tool for strategy refinement rather than a guarantee of future performance. Traders should continue to monitor and adjust their strategies in real-time based on market conditions and trends.

However, it is important to note that backtesting results are based on historical data and should be used as a tool for strategy refinement rather than a guarantee of future performance. Traders should continue to monitor and adjust their strategies in real-time based on market conditions and trends.

MetaTrader 4 (MT4) is a trading platform developed by MetaQuotes Software Corp. It is widely used by traders around the world for forex trading. MT4 is known for its user-friendly interface and powerful features that allow traders to analyze and execute trades effectively. With MT4, traders can access real-time market data, trade various financial instruments, use technical analysis tools, and implement automated trading strategies.

MetaTrader 4 is considered a safe trading platform. It incorporates various security measures to protect user data and ensure secure transactions. Some of the safety features include encrypted data transmission, password protection, and two-factor authentication. Additionally, reputable brokers that offer MetaTrader 4 are often regulated by relevant financial authorities, providing an additional layer of security.

While MetaTrader 4 is primarily known for forex trading, it also allows traders to access and trade other financial instruments. These instruments include stocks, indices, commodities, and cryptocurrencies. The availability of these instruments may vary depending on the broker’s offerings. Traders can use the same MT4 platform and its features to analyze and execute trades across multiple markets, making it a versatile platform for various trading needs.

Yes, the MetaTrader 4 platform is free to download and use. Traders can access the MT4 platform without any upfront costs. However, it is essential to note that while the platform itself is free, traders may incur fees related to trading activities such as spreads, commissions, and swap charges. These fees vary depending on the broker and the financial instruments being traded.

MT4 indicators are technical analysis tools used by traders to analyze market trends and identify potential trading opportunities. These indicators are mathematical calculations based on historical price data and assist traders in making informed trading decisions. Some popular MT4 indicators include moving averages, MACD, RSI, Bollinger Bands, and Fibonacci retracement.

MT4 and MT5 are both trading platforms developed by MetaQuotes Software Corp. Although they share similarities, there are key differences between the two platforms. MT4 primarily focuses on forex trading, while MT5 offers a broader range of markets, including stocks, futures, and options. MT5 introduces a new order execution system called “Market Depth,” which provides more transparency and depth of market information. MT4 uses MQL4 for programming indicators and expert advisors, while MT5 uses MQL5. MT5 introduces more timeframes compared to MT4, allowing for finer-grained analysis.

Trade forex, indices, metal, and more at industry-low spreads and lightning-fast execution.

Sign up for a PU Prime Live Account with our hassle-free process.

Effortlessly fund your account with a wide range of channels and accepted currencies.

Access hundreds of instruments under market-leading trading conditions.